Online mortgage lender Better.com goes public on Nasdaq despite challenges in the home-buying market. CEO Vishal Garg outlines plans to enhance services and seize future opportunities.

Table of Contents

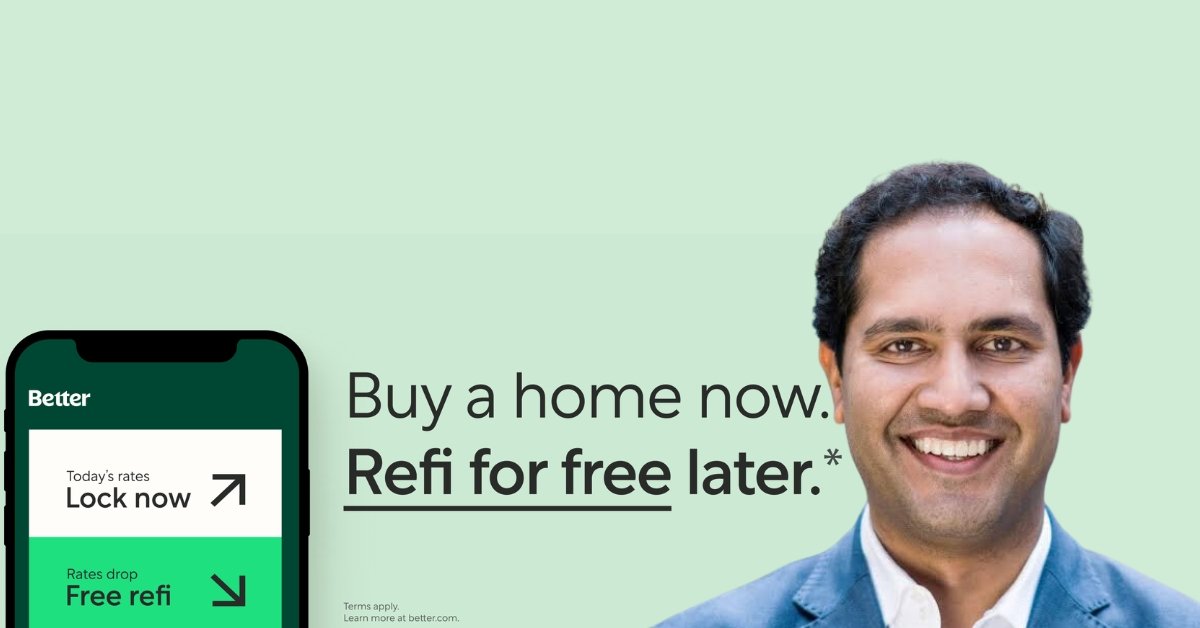

Better.com

Better.com, an online mortgage company, has decided to become a public company even though buying homes has become harder.

What Just Happened?

Better.com, a company that helps people get mortgages online, has done something important. They joined with another company called Aurora Acquisition Corp., and now they can be bought and sold on the Nasdaq stock exchange. This is a big step for Better.com.

Why Is This Interesting?

Even though it could be a better time to buy houses, Better.com thinks becoming a public company is a good idea. The CEO, Vishal Garg, believes they will have many growth opportunities.

Why Are Houses Hard to Buy?

Getting mortgages (loans to buy homes) has become tougher. This happened because the people who control money in the US (the Federal Reserve) raised interest rates. This makes loans more expensive. When loans are expensive, people want to avoid buying houses or refinance them.

Tough Times for Companies

Companies that give out mortgages have had a tough year. They lost money on each loan they gave out at the beginning of 2023. It improved in the next few months, but many people still wanted to refrain from refinancing their homes, and others could not afford to buy because of high rates and fewer homes available.

What is Better.com’s Plan?

Even though things are hard, Better.com wants to keep going. They are getting more than $500 million from a company called SoftBank to help them. They want to make their services better and faster. They also want to use smart computer programs and buy other companies.

What Might Happen Next?

Loan rates will go down soon. This means more people might want to buy houses or refinance. Better.com wants to be ready for this and help people get mortgages quickly with their “One Day Mortgage” idea.

Learning from Mistakes

Better.com had some problems before, like when they laid off many employees. The CEO, Vishal Garg, says they have learned from these mistakes and want to be more careful in the future.

Conclusion

In conclusion, even though it is not easy to buy homes right now, Better.com is taking a big step by becoming a public company. They plan to do better and help people get mortgages faster when things get better in the housing market.

Get our best stuff sent straight to you! Join our WhatsApp Channel.